Bad Credit Car Loan Checklist: 7 Things Arnold Lenders Want to See Before They Say 'Yes' in 2026

![[HERO] Bad Credit Car Loan Checklist: 7 Things Arnold Lenders Want to See Before They Say 'Yes' in 2026](https://cdn.marblism.com/fxT-eMb0CPA.webp)

Let's be real, getting approved for a car loan with less-than-perfect credit can feel like trying to solve a puzzle blindfolded. But here's the good news: lenders in Arnold aren't just looking at that three-digit number. They want to see the whole picture of who you are and whether you can handle the monthly payments.

At Grateful Motors, we work with folks every single day who thought they'd never get approved. And you know what? Most of them drive off our lot with keys in hand. The secret isn't magic, it's knowing exactly what lenders want to see and showing up prepared.

So let's break down the 7 things Arnold lenders are looking for in 2026, and how you can check every single box.

1. Proof of Income: Show Me the Money

This is the big one. Lenders want proof that you're bringing in steady cash each month. Your credit score might be in the 500s, but if you can show consistent income, you're already halfway there.

What counts as proof? Recent pay stubs (usually the last two months), tax returns, Social Security or disability benefits statements, or even pension documentation. If you're self-employed, bring your tax returns from the last year or two.

Most Arnold lenders want to see a minimum monthly income between $1,500 and $2,500. Some might require at least $21,600 annually. The stronger your income documentation, the better your shot at approval, and potentially better interest rates.

Pro tip: Gather more than you think you need. If you have multiple income sources, bring documentation for all of them. It shows financial stability and gives lenders confidence that you can handle the payment even if one income stream dips.

2. Employment History: Prove You're Not a Job Hopper

Lenders love stability. If you've been at your current job for at least six months, that's a green light. It tells them you're not likely to suddenly lose your income next month.

Your pay stubs usually cover this requirement, but some lenders might ask for a verification letter from your employer. Don't panic if you recently switched jobs, as long as you stayed in the same field and your income stayed steady (or increased), most lenders will work with you.

What if you're between jobs or work gig-economy jobs? It gets trickier, but it's not impossible. At Grateful Motors, we've helped people in all kinds of employment situations. The key is being upfront and showing whatever income documentation you have.

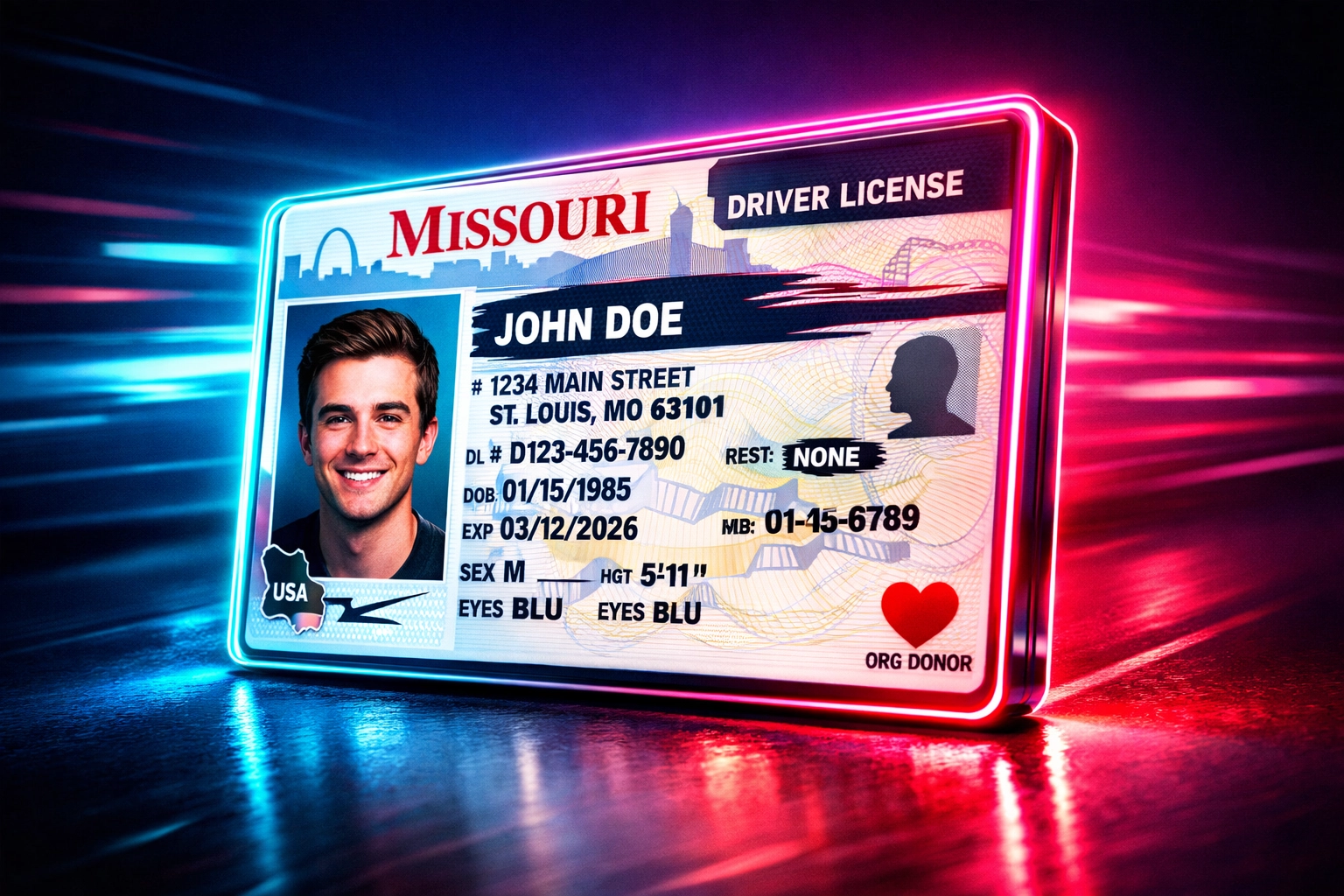

3. Valid Driver's License: The No-Brainer

You need a current, valid driver's license. Period. This verifies your identity and confirms you can legally drive the vehicle you're buying.

Make sure it's not expired and that the address matches your proof of residence (more on that in a second). If you recently moved to Arnold from another state, get that Missouri license updated before you start car shopping.

4. Proof of Residence: Where Do You Actually Live?

Lenders want confirmation that you have a stable living situation. Bring a recent utility bill, lease agreement, mortgage statement, or even a bank statement with your current address.

The document should be dated within the last 60-90 days and match the address on your driver's license. If you just moved and your IDs don't match yet, bring both the new proof of residence and an explanation. Most lenders in Arnold are pretty understanding about this.

5. Your Credit History: It's Not Just About the Score

Yes, they're going to pull your credit report. But here's what a lot of people don't realize: they're not just looking at that score. They're reading the story behind it.

Did you have a rough patch a few years ago but you've been making on-time payments lately? That's huge. Are you maxed out on all your credit cards right now? That's a red flag. Do you have a recent repossession or bankruptcy? That makes things harder, but not impossible.

The best thing you can do before applying is to check your own credit report (you can do this for free at AnnualCreditReport.com). Look for errors and dispute them. Make sure all your current bills are paid on time in the months leading up to your car purchase.

If you've had credit challenges, be ready to explain what happened and what's changed. Lenders appreciate honesty and a clear plan forward.

6. Down Payment: Cash Talks

Bringing a down payment shows you're serious and lowers the lender's risk. For bad credit situations, expect to put down at least 10% of the vehicle's price, though more is always better.

Let's say you're looking at a reliable 2019 Ford Escape. If it's priced at $15,000, aim for at least a $1,500 down payment. If you can scrape together $2,500 or $3,000? Even better. It lowers your monthly payment, reduces the total interest you'll pay, and makes lenders way more comfortable saying yes.

No cash saved up? Check out our Sign and Drive inventory: we work with certain lenders who can get you approved with little to no money down in specific situations.

7. The Right Vehicle: Not All Cars Qualify

Here's something that catches people off guard: lenders have rules about which vehicles they'll finance, especially for bad credit loans.

Common restrictions include:

Vehicle can't be more than 10 years old

Mileage under 125,000-150,000 miles (depends on the lender)

No salvage or branded titles

Minimum value around $4,000

Certain makes and models might be excluded

This is why working with a dealership like Grateful Motors makes life easier. We already know which vehicles in our inventory qualify for various financing programs. We're not going to waste your time showing you something you can't actually get financed.

Looking at trucks? Check out this 2016 Chevrolet Silverado 1500: solid vehicle that typically qualifies with most lenders. Need something with more space? The 2017 Dodge Durango is another popular option that checks the boxes.

Bonus Tip: References and Insurance

Some lenders might ask for personal or professional references: people who can vouch that you're responsible and reachable. Have names, phone numbers, and addresses ready for at least 3-5 references who aren't family members.

You'll also need proof of insurance before you can drive off the lot. Call your insurance company before you go car shopping to get a quote and understand what coverage you'll need.

What to Bring to Grateful Motors

When you're ready to visit us in Arnold, make your life easier by bringing everything in one shot:

Valid driver's license

Two recent pay stubs (or other proof of income)

Proof of residence (utility bill, lease agreement, etc.)

List of references with contact info

Down payment (if you have one)

Insurance information or agent contact

Having all this ready shows you're serious and speeds up the whole process. We've had customers go from application to approved in the same day when they come prepared.

The Arnold Advantage: Local Lenders Know Local People

Here's something a lot of people don't think about: working with a dealership that has relationships with local and regional lenders makes a huge difference. At Grateful Motors, we're not sending your application to some faceless corporation three states away. We work with lenders who understand the Arnold area, the local job market, and the kinds of financial situations real people in Jefferson County face.

That local connection has saved countless deals that would've been rejected elsewhere.

Ready to Get Started?

Bad credit doesn't mean no car. It just means you need to show up prepared and work with people who actually want to help you succeed.

Stop by Grateful Motors on Richardson Road, or start your journey online by filling out a credit application. We'll review what you've got, explain your options honestly, and work to find a solution that gets you driving.

Browse our current inventory to see what catches your eye, and don't sleep on our Sign and Drive options if you need to minimize upfront costs.

Your credit score is just one chapter of your story: it's not the ending. Let's write the next one together, with you behind the wheel of a reliable vehicle that fits your life and your budget.